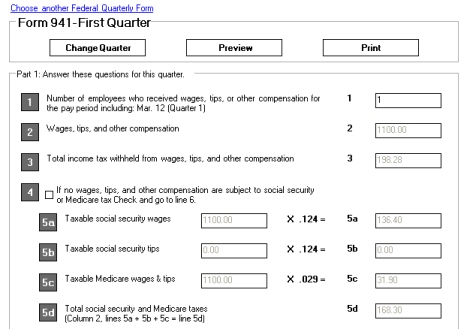

Irs form 941+instructions - employer quarterly federal tax return, Irs form 941, or we know it as the employer’s quarterly federal tax return form is used to report employment taxes which are: federal income tax withholding, social.

Form 941, employer's quarterly federal tax return, Comment on form 941. send us an email or use the comment on tax forms and publications web submission form to provide us feedback on the content of the.

Federal tax forms 2013 federal tax forms archives » federal tax, Irs form 941 is a quarterly federal tax return form that all employers should file with internal revenue service (irs) of the united states. irs has mandated that all.

Tax topics - topic 758 form 941 – employer's quarterly federal, Topic 758 - form 941 – employer's quarterly federal tax return and form 944 – employer's annual federal tax return. generally, you will file form.

What federal income tax form do i use to file quarterly estimated, If you’re self employed or otherwise don’t have taxes regularly withheld, you must file your own taxes. payments are made every quarter. that means your tax day.

2012 estimated quarterly federal tax vouchers .pdf full version, Results for 2012 estimated quarterly federal tax vouchers high speed direct downloads 2012 estimated quarterly federal tax vouchers [full version].

Labels: Workers