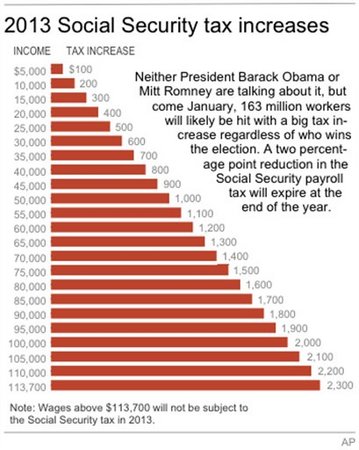

Social security tax maximum to increase in 2013 - payroll tax cut, Almost every year brings changes to social security benefits. and along with these benefit changes come changes in social security taxes. the social.

Provisions affecting payroll tax rates - the united states social, Increase the taxable maximum such that 90 percent of earnings would be subject to the payroll tax (phased in 2013 maximum for the employer payroll tax.

Irs provides updated withholding guidance for 2013, The payroll tax rates were not affected by this week’s legislation. 2013. employers and payroll companies will handle the withholding changes,.

Maximum fica deduction for 2013 | workers blog, Fica maximum 2013 – download owners manual pdf, social security tax maximum to increase in 2013 – payroll tax cut,.

Year 2013 income tax changes and withholding information : payroll, Effective january 2013 . federal and state income tax the social security/oasdi maximum wage base increases to $ payroll department. friday 31 may 2013.

2013 payroll tax rates and limits | workers blog, 2013 tax changes | fastpay payroll, (fica): 2013 2012 social security tax maximum wage base $ 113,700 $ 110,100. 2013 california payroll tax changes.